EPF is a great way to get someone other than yourself namely your employer to contribute to your retirement. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia.

What Is Epf Deduction Percentage Quora

Allowances not earned by all Employees are not subject to PF contribution.

. Access to internet banking makes EPF contribution payments much easier now. Hi Aries For any Variable Pay that you would not want to. EPF contribution is that it qualifies for tax deduction by way.

The standard practice for EPF contribution by. On 28 February 2019 the Supreme Court of India ruled that special allowances will be included in the scope of basic wages and shall therefore be subject to Employees. Salaries Payment for unutilised annual or medical leave Bonuses Allowances with some exceptions Commissions Incentives.

What is the contribution for provident fund by the employee and employer. The main purpose of EPF savings is for ones retirement this savings consists of the EPF contribution by employer and employee. However as the word is broad enough to include payments for.

Wages Wages in lieu of notice of. 5 years 6 months ago 1041. In general all monetary payments that are meant to be wages are subject to EPF contribution.

8 of the total monthly earnings To be deducted from the employees. While the act specifies that allowances are subject to EPF it also specifies an overruling criteria whereby any travelling allowance or the value of any travelling concession. Generally all wages paid to the directorsstaffemployeeworkers are subject to EPF deductions.

Trip allowance is included in wage elements. Allowance Allowance except travelling allowance is included in the definition of wages under the EPF Act. Through voluntary contribution EPF members can contribute to their EPF account anytime with any amount as long as the amount does not exceed the allowed maximum.

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be. Any contribution payable by the employer towards any pension or. The answer according to the official EPF website is clear.

Salaries Payments for unutilised annual or medical leave. Subject to the provisions of section 52 every employee and every employer of a person who is. In general all monetary payments that are meant to be wages are subject to EPF contribution.

Wages are all remuneration in money due to your employee under his contract of service or apprenticeship. EPF members in the private and non-pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers. Replied by Kap-Chew on topic PetrolFood Allowance is part of EPF Contribution.

Salaries Payments for unutilized annual or medical leave. Monetary payments that are subject to EPF contribution are. The payments below are not considered wages and are not included in the calculations for monthly deductions.

Special allowances that form part of Basic wages are subject to PF contributions. Allowance Allowance except travelling allowance is included in the definition of wages under the EPF Act. The payments by the employers subject to deductions are.

Is a drivers trip allowance subject to EPF contribution. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 4 Why this discussion Background Supreme Court rules allowances in question are subject to PF.

Note On Employee Provident Fund Epf

Epf Withdrawal Rules 2022 All You Need To Know

Today 28 Th November Sunday Dinamalar Jobs Openings In Coimbatore District And Surrounding Areas Job Opening Job Hr Management

What Is The Wage Limit For Epf There Are 45 Employees In My Company But The Management Is Not Giving Me Pf Saying That It Is Mandatory To Give Pf Only To

Declaration Of Rate Of Interest For The Employees Provident Fund Members Account For The Year 2021 22 Https Www Staffnews In 2022 In 2022 Fund Accounting Government

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

Uan Password Forgot How To Reset Change Epfo Login Password Passwords Passbook Reset

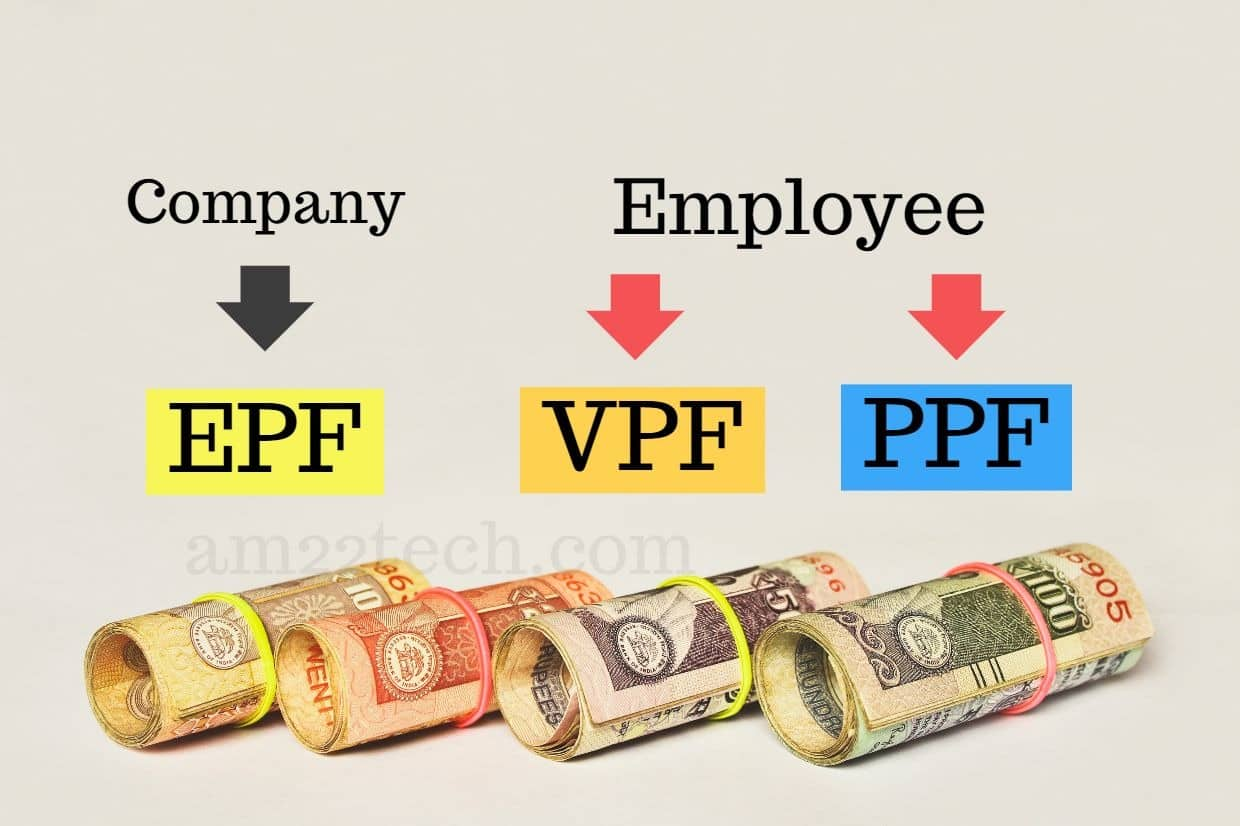

Epf Vs Ppf Vs Vpf Ctc And Salary Slip India

Concession In Home Loan Interest Rates Clss Pmay U

Aibea Circular Bipartite Talks With Iba On 31 10 2020 Moving Towards Final Settlement Talk Moving Finals

Rajasthan Postal Circle Holiday List 2021 Post Office Holidays 2021 Holiday List Office Holiday Post Office

Nps To Ops Scrapping Of National Pension System And Extending Coverage Of The Old Pension Scheme Under Ccs Pension Rules 1972 For A Pensions National Nps

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

What Payments Are Subject To Epf Donovan Ho

Benefits Of Investing In Epf Niyo

What Is The Wage Limit For Epf There Are 45 Employees In My Company But The Management Is Not Giving Me Pf Saying That It Is Mandatory To Give Pf Only To

Payment Of Dearness Allowance Armed Forces Officers And Pbors Including Ncs E Revised Rates Dearness Allowance Armed Forces Allowance

When It Comes To Provident Fund And Esi Funds It Is Important That Employees Know The Protocol Of Handling Non Compliant Situations Law Firm Consulting Case